The Office of the Honourable Minister of Finance and Coordinating Minister of the Economy released a new Withholding Tax (WHT) Regulations tagged “Deduction of Tax at Source (Withholding) Regulations 2024”. The new WHT Regulations supersedes the previous WHT Regulations and complements applicable statutory provisions in respect of deductions of tax at source other than Pay-As-You-Earn tax.

Major Highlights

Legal Basis:

The principal legislation, the Companies’ Income Tax Act (CITA) and Personal Income Tax Amendment Act (PITAM), provide the legal basis for the new WHT Regulations. Specifically, section 81 (9) of CITA and section 73 (6) of PITAM provide that the Minister of Finance may make regulations for administering the deduction of tax at source.

Persons Required to Make Deductions at Source

The following persons are required to make WHT deduction at source:

- Body corporate or unincorporate including sole proprietorships, partnerships, limited liability companies, trusts, joint ventures, non-governmental organizations, etc other than individuals. Hence, individuals are not required to deduct WHT from payments for goods and services whether or not a contractual agreement exists.

- The Federal, State, and Local Governments as well as the Government Ministries, Departments and Agencies.

- The various statutory bodies of the Federal, State and Local Governments

- Public authorities

- Institutions, organizations, establishments, and enterprises including those exempt from tax

- Any person acting as a payment agent on behalf of any of the persons above

Please note that any small business or company with turnover of N25 million and below is exempt from the obligation to deduct WHT at source provided that the supplier/ vendor has a valid Tax Identification Number (TIN) and the value of the transaction is N2 million or less during a calendar month.

Eligible Transactions & Applicable Rates:

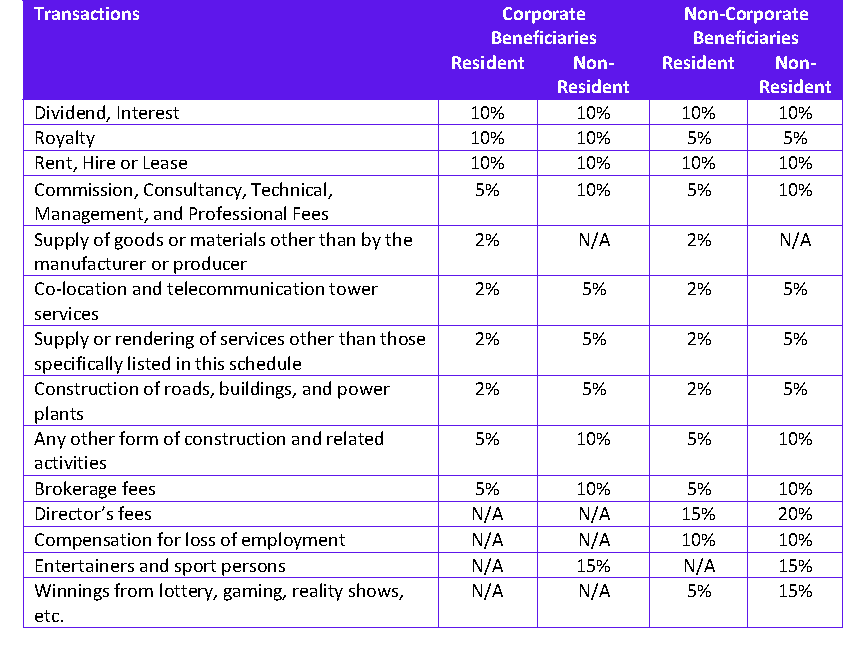

The new WHT Regulations specifies the eligible transactions and the applicable WHT rates for corporate and non-corporate beneficiaries including residents and non-residents as follows:

It is important to highlight that the applicable WHT rate for commission, technical & professional fees has been reviewed downwards from 10% to 5% for corporate beneficiaries. Also, the ambiguity around the applicable WHT rates for co-location and telecommunication tower services, entertainers and sport persons and winnings from lottery, gaming, reality shows, etc. has been laid to rest.

Timing of Obligation

Based on the new WHT Regulations, the obligation to deduct WHT arises at the earlier of when the payment for a transaction is made or the amount due is settled. This is a departure from the previous provisions which stipulates that WHT is due at the earlier of when payment is made or accrued in the books of the payer.

Please note however that for related parties, the new provision will not apply and status quo remains. Further, WHT deductions and payments due to the Federal Inland Revenue Service (FIRS) should be remitted not later than the 21st day of the month following the month of payment, while payment due to the State Internal Revenue Service should be remitted not later than the 30th day of the month following the month of payment.

The WHT Returns

Taxpayers are mandated by law to submit WHT Returns to the relevant tax authorities along with the evidence payment of WHT deducted at source. The WHT return should reflect the following information:

- Name and address of the payer and beneficiaries

- TIN, RC Number, etc of the payer and beneficiaries

- Nature of transaction in respect of which payment is made

- Gross amount paid or payable

- Amount of tax deducted

- Calendar month or period covered

Issuance of WHT Receipts by Person making Deduction & Payment

The obligation to issue WHT receipts has been shifted from the various tax authorities to the person making WHT deduction and payment. The new WHT Regulation mandates any person who has deducted WHT and made payment of such WHT to the relevant tax authorities to issue a WHT receipts in respect of such payment. Thereafter, the beneficiary will present such WHT receipts to the relevant tax authority for the purpose of claiming tax credit.

Where a beneficiary presents a WHT receipts to the tax authority and such payment has not been received, the tax authority will grant tax credit to the beneficiary but will treat the outstanding WHT as a tax liability against the person who issued the WHT receipts.

The WHT receipts should reflect the following information:

- Name, address and TIN of the beneficiary. Where the beneficiary does not have a TIN, the National Identification Number or RC number can be used for individuals or companies, respectively.

- Nature of transaction

- Gross amount paid or payable

- WHT Amount deducted

- Month or period covered

Exemption from WHT Deduction at Source

The list of transactions exempted from WHT deduction at source are as follows:

- Compensating payments under a Registered Securities Lending Transaction (Section 81(8) of CITA)

- Any distribution or dividend payment to a Real Estate Trust or Real Estate Investment Company (Section 80(5) of CITA)

- Across the counter transaction

- Interest and fees paid to Nigerian banks by way of direct debit of funds which are domiciled with the bank

- Goods manufactured or materials produced by the person making the supply

- Imported goods where the transaction does not create a taxable presence for the non-resident supplier

- Any payment of income or profit which is exempt from tax

- Out of pocket expenses incurred by the supplier and is separated from the contract fees

- Insurance premium

- Supply of liquefied petroleum gas, compressed natural gas, premium motor spirit, automotive gas oil, low pour fuel oil, dual purpose kerosene and JET-A1.

- Commission retained by a broker from monies collected on behalf of the principal in line with the industry norm.

- Winnings from a game of chance or a reality show with contents designed to promote entrepreneurship, academics, technological or scientific innovation

Please note that the WHT exemption does in any way affect the obligation of the beneficiaries to make income tax payments.

Commencement Date: The commencement date for the implementation of the new WHT Regulations is 1 January 2025.

Conclusion

The reduction of the WHT rate for industries with low margins is a welcome development as it will go a long way to simplify areas of complexities and ambiguity. Also, the new Regulation will aid the ease of business, strengthen tax compliance and administration, and reduce arbitrage between corporate and non-corporate businesses.

The consideration of emerging issues such as co-location and telecommunication tower services, entertainers and sport persons and winnings from lottery, gaming, reality shows reflects the government’s interest in aligning of our tax system with current realities and global best practices.